car lease tax benefit

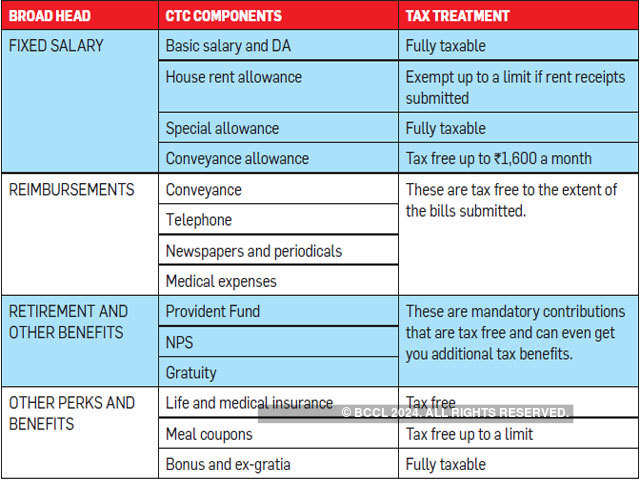

The lease payments are calculated so that over the three-year term they equal 40000 minus the residual value at the. 150000 is allocated towards car maintenance insurance fuel and driver allowance.

When Does Leasing A Company Car Save You Tax India News Times Of India

Answer 1 of 3.

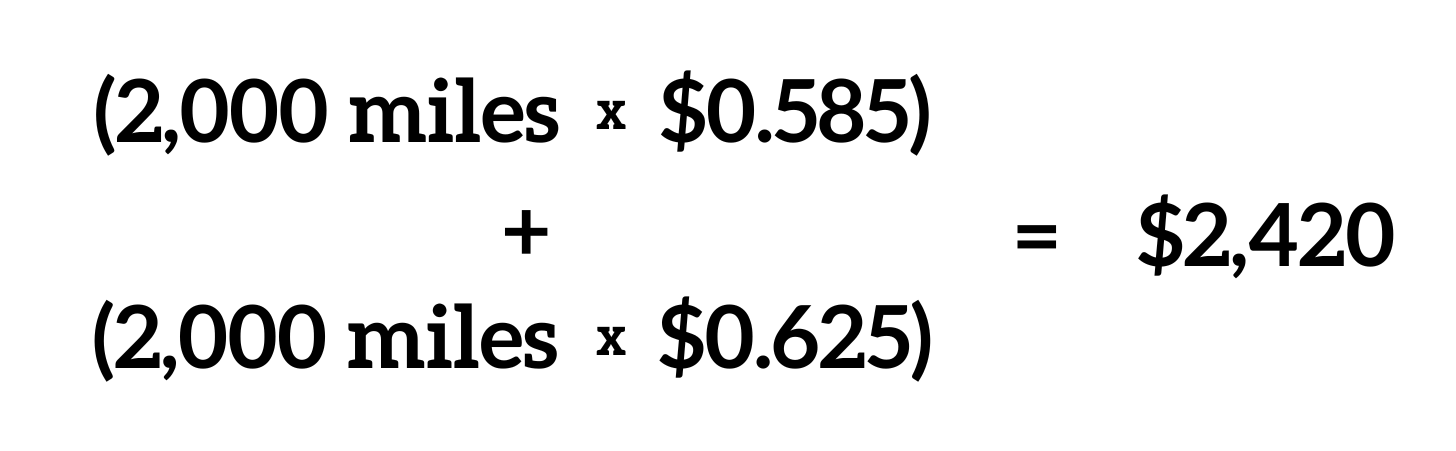

. If you use your leased vehicle for business purposes you can generally directly deduct the costs as business expenses monthly payments insurance mileage maintenance. As previously mentioned business leasing can provide considerable tax benefits. This is applicable for self-employed as well.

We never hassle or. Check if you need to pay tax for charging an employees electric car. RCW 82090203 in Washington State requires an additional tax of 03 on the sale or lease of all.

The lease amount you pay for a vehicle is eligible for tax relief. Leasing a vehicle could help you save as much as 30 on your taxes. Out of this Rs.

When an employer talks about your salary they mean your basic starting salary. Some states require you to pay an additional tax on a car lease. Various components are then added to this number to create your final salary package.

Actual amount incurred by the employer. You can call us at 516-780-0679 for a free consultation or use the Case Evaluation Form on our web site. In another state once Illinois finds out about it they will charge the Illinois use tax which is.

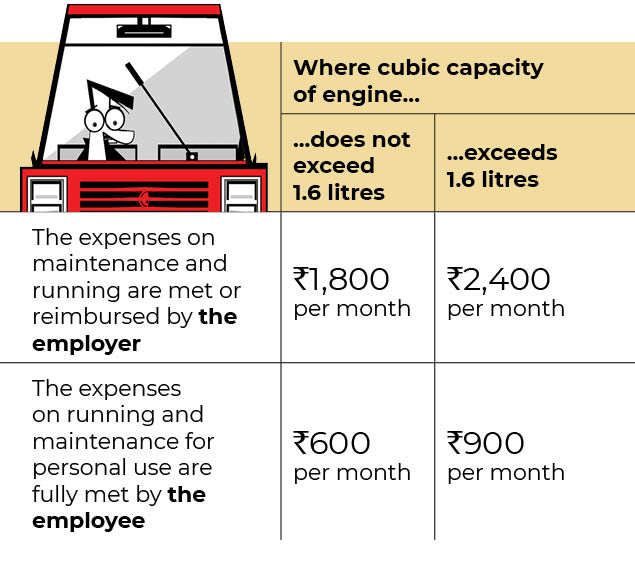

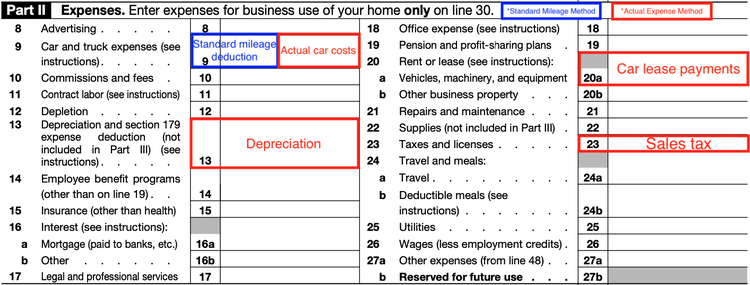

Deduct a amount of Rs 2400 from the above figure for a car above 16 litres OR a amount of. First and foremost we will want to see. But leasing may get you Section 179 tax advantages.

It really is that simple. The lease terms are. You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a.

The computation of tax implications will be as follows. Tax on company benefits. Feel free to take your time when browsing our through our line of automobiles.

200000 is your car lease amount and another Rs. If you are a self-employed individual or a business owner here is how you can claim your car loan income tax benefits. If an Illinois resident purchases a car plane boat etc.

Created to provide corporate clients with a variety of operational financial and management programs TBBK Direct Leasing continues to design customized business. FMC as lessor pay the dealer the 40000 balance. We even allow our clients to submit their auto lease application online.

What documents will you ask me to provide. Show you use the car for legitimate business purpose. The leasing company or fleet provider if you lease the car.

I paid the NY state tax. Section 179 of the Internal Revenue Code allows you to fully deduct the cost of some newly purchased assets in the first yearbut your.

The Potential Tax Benefits Of Car Leasing Vs Buying Supermoney

Five Myths About Leasing A Car Kiplinger

Savings For Employers Using Automobile Lease Valuation Rule

How To Deduct Car Lease Payments In Canada

Car On Lease How To Cut Your Tax Outgo The Economic Times

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Take A Tax Deduction For The Business Use Of Your Car

Benefits Of Leasing Vs Buying Positive Lending Solutions

Understanding Tax On A Leased Car Capital One Auto Navigator

Is It Better To Buy Or Lease A Car Taxact Blog

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

Are Car Lease Payments Tax Deductible Mileiq

How To Write Off A Car Lease For Your Business In 2022

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Austin Tax Season Car Deals For Kia

Do You Pay Sales Tax On A Lease Buyout Bankrate

Car Leasing And Taxes Points To Ponder Credit Karma

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds